The morals of trade

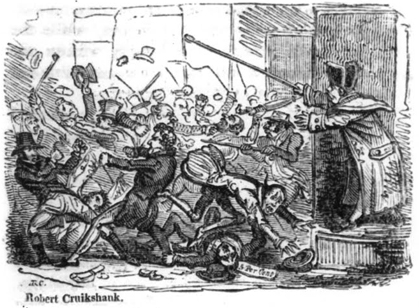

[First published in The Westminster Review for April 1859.]

We are not about to repeat, under the above title, the often-told tale of adulterations: albeit, were it our object to deal with this familiar topic, there are not wanting fresh materials. It is rather the less-observed and less-known dishonesties of trade, to which we would here draw attention. The same lack of conscientiousness which shows itself in the mixing of starch with cocoa, in the dilution of butter with lard, in the colouring of confectionery with chromate of lead and arsenite of copper, must of course come out in more concealed forms; and these are nearly, if not quite, as numerous and as mischievous.

It is not true, as many suppose, that only the lower classes of the commercial world are guilty of fraudulent dealing. Those above them are to a great extent blameworthy. On the average, men who deal in bales and tons differ but little in morality from men who deal in yards and pounds. Illicit practices of every form and shade, from venial deception up to all but direct theft, may be brought home to the higher grades of our commercial world. Tricks innumerable, lies acted or uttered, elaborately-devised frauds, are prevalent: many of them established as “customs of the trade;” nay, not only established, but defended.

Passing over, then, the much-reprobated shopkeepers, of whose delinquencies most people know something, let us turn our attention to the delinquencies of the classes above them in the mercantile scale.

The business of wholesale houses—in the clothing-trades at least—is chiefly managed by a class of men called “buyers.” Each wholesale establishment is usually divided into several departments; and at the head of each department is placed one of these functionaries. A buyer is a partially-independent sub-trader. At the beginning of the year he is debited with a certain share of the capital of his employers. With this capital he trades. From the makers he orders for his department such goods as he thinks will find a market; and for the goods thus bought he obtains as large a sale as he can among the retailers of his connexion. The accounts show at the end of the year what profit has been made on the capital over which he has command; and, according to the result, his engagement is continued—perhaps at an increased salary—or he is discharged.

Under such circumstances, bribery would hardly be expected. Yet we learn, on unquestionable authority, that buyers habitually bribe and are bribed. Giving presents, as a means of obtaining custom, is an established practice between them and all with whom they have dealings. Their connexions among retailers they extend by treating and favours; and they are themselves influenced in their purchases by like means. It might be presumed that self-interest would in both cases negative this. But apparently, no very obvious sacrifice results from yielding to such influences. When, as usually happens, there are many manufacturers producing articles of like goodness at the same prices, or many buyers between whose commodities and whose terms there is little room for choice, there exists no motive to purchase of one rather than another; and then the temptation to take some immediate bonus turns the scale. Whatever be the cause, however, the fact is testified to us alike in London and the provinces. By manufacturers, buyers are sumptuously entertained for days together, and are plied throughout the year with hampers of game, turkeys, dozens of wine, etc.: nay, they receive actual money-bribes; sometimes, as we hear from a manufacturer, in the shape of bank-notes, but more commonly in the shape of discounts on the amounts of their purchases. The extreme prevalence—universality we might say—of this system, is proved by the evidence of one who, disgusted as he is, finds himself inextricably entangled in it. He confessed to us that all his transactions were thus tainted. “Each of the buyers with whom I deal,” he said, “expects an occasional bonus in one form or other. Some require the bribe to be wrapped up; and some take it without disguise. To an offer of money, this one replies—‘Oh, I don’t like that sort of thing,’ but nevertheless, does not object to money’s-worth; while my friend So-and-so, who promises to bring me a large trade this season, will, I very well know, look for one per cent. discount in cash. The thing is not to be avoided. I could name sundry buyers who look askance at me, and never will inspect my goods; and I have no doubt about the cause—I have not bought their patronage.” And then our informant appealed to another of the trade, who agreed in the assertion that in London their business could not be done on any other terms. So greedy do some of these buyers become, that their perquisites absorb a great part of the profits, and make it a question whether it is worth while to continue the dealing with them. Next, as above hinted, there comes a like history of transactions between buyers and retailers—the bribed being now the bribers. One of those above referred to as habitually expecting douceurs, said to the giver of them, whose testimony we have just repeated—“I’ve spent pounds and pounds over ―― (naming a large tailor), and now I think I have gained him over.” To which confession this buyer added the complaint, that his house did not make him any allowance for sums thus disbursed.

Under the buyer, who has absolute control of his own department in a wholesale house, come sundry assistants, who transact the business with retail traders; much as retail trader’s assistants transact the business with the general public. These higher-class assistants, working under the same pressure as the lower, are similarly unscrupulous. Liable to prompt dismissal as they are for failure in selling; gaining higher positions as they do in proportion to the quantities of goods they dispose of at profitable rates; and finding that no objections are made to any dishonest artifices they use, but rather that they are applauded for them; these young men display a scarcely credible demoralization. As we learn from those who have been of them, their duplicity is unceasing—they speak almost continuous falsehood; and their tricks range from the simplest to the most Machiavellian. Take a few samples. When dealing with a retailer, it is an habitual practice to bear in mind the character of his business; and to delude him respecting articles of which he has least experience. If his shop is in a neighbourhood where the sales are chiefly of inferior goods (a fact ascertained from the traveller), it is inferred that, having a comparatively small demand for superior goods, he is a bad judge of them; and advantage is taken of his ignorance. Again, it is usual purposely to present samples of cloths, silks, etc., in such order as to disqualify the perceptions. As, when tasting different foods or wines, the palate is disabled by something strongly flavoured, from appreciating the more delicate flavour of another thing afterwards taken; so with the other organs of sense, a temporary disability follows an excessive stimulation. This holds not only with the eyes in judging of colours, but also, as we are told by one who has been in the trade, it holds with the fingers in judging of textures; and cunning salesmen are in the habit of thus partially paralysing the customers’ perceptions, and then selling second-rate articles as first-rate ones. Another common manœuvre is that of raising a false belief of cheapness. Suppose a tailor is laying in a stock of broad cloths. He is offered a bargain. Three pieces are put before him—two of good quality, at, perhaps, 14s. per yard; and one of much inferior quality, at 8s. per yard. These pieces have been purposely a little tumbled and creased, to give an apparent reason for a pretended sacrifice upon them. And the tailor is then told that he may have these nominally-damaged cloths as “a job lot,” at 12s. per yard. Misled by the appearances into a belief of the professed sacrifice; impressed, moreover, by the fact that two of the pieces are really worth considerably more than the price asked; and not sufficiently bearing in mind that the great inferiority of the third just balances this; the tailor probably buys; and he goes away with the comfortable conviction that he has made a specially-advantageous purchase, when he has really paid the full price for every yard. A still more subtle trick has been described to us by one who himself made use of it, when engaged in one of these wholesale-houses—a trick so successful that he was often sent for to sell to customers who could be induced to buy by none other of the assistants, and who ever afterwards would buy only of him. His policy was to seem extremely simple and honest, and, during the first few purchases, to exhibit his honesty by pointing out defects in the things he was selling; and then, having gained the customer’s confidence, he proceeded to pass off upon him inferior goods at superior prices. These are a few out of the various manœuvres in constant practice. Of course there is a running accompaniment of falsehoods, uttered as well as acted. It is expected of the assistant that he will say whatever is needed to effect a sale. “Any fool can sell what is wanted,” said a master in reproaching a shopman for not having persuaded a customer to buy something quite unlike that which he asked for. And the unscrupulous mendacity thus required by employers, and encouraged by example, grows to a height of depravity that has been described to us in words too strong to be repeated. Our informant was obliged to relinquish his position in one of these establishments, because he could not lower himself to the required depth of degradation. “You don’t lie as though you believe what you say,” observed one of his fellow-assistants. And this was uttered as a reproach!

As those subordinates who have fewest qualms of conscience are those who succeed the best, are soonest promoted to more remunerative posts, and have therefore the greatest chances of establishing businesses of their own; it may be inferred that the morality of the heads of these establishments, is much on a par with that of their employés. The habitual malpractices of wholesale houses, confirm this inference. Not only, as we have just seen, are assistants under a pressure impelling them to deceive purchasers respecting the qualities of the goods they buy, but purchasers are also deceived in respect to the quantities; and that, not by an occasional unauthorized trick, but by an organized system, for which the firm itself is responsible. The general practice is to make up goods, or to have them made up, in lengths that are shorter than they profess to be. A piece of calico nominally thirty-six yards long, never measures more than thirty-one yards—is understood throughout the trade to measure only so much. And the long-accumulating delinquencies which this custom indicates—the successive diminutions of length, each introduced by some adept in dishonesty, and then imitated by his competitors—are now being daily carried to a still greater extent, wherever they are not likely to be immediately detected. Articles that are sold in small bundles, knots, packets, or such forms as negative measurement at the time of sale, are habitually deficient in quantity. Silk-laces called six quarters, or fifty-four inches, really measure four quarters, or thirty-six inches. Tapes were originally sold in grosses containing twelve knots of twelve yards each; but these twelve-yard-knots are now cut of all lengths, from eight yards down to five yards, and even less—the usual length being six yards. That is to say, the 144 yards which the gross once contained, has now in some cases dwindled down to 60 yards. In widths, as well as in lengths, this deception is practised. French cotton-braid, for instance (French only in name), is made of different widths; which are respectively marked 5, 7, 9, 11, etc.: each figure indicating the number of threads of cotton which the width includes, or rather should include, but does not. For those which should be marked 5 are marked 7; and those which should be marked 7 are marked 9: out of three samples from different houses shown to us by our informant, only one contained the alleged number of threads. Fringe, again, which is sold wrapped on card, will often be found two inches wide at the end exposed to view, but will diminish to one inch at the end next the card; or perhaps the first twenty yards will be good, and all the rest, hidden under it, will be bad. These frauds are committed unblushingly, and as a matter of business. We have ourselves read in an agent’s order-book, the details of an order, specifying the actual lengths of which the articles were to be cut, and the much greater lengths to be marked on the labels. And we have been told by a manufacturer who was required to make up tapes into lengths of fifteen yards, and label them “warranted 18 yards,” that when he did not label them falsely, his goods were sent back to him; and that the greatest concession he could obtain was to be allowed to send them without labels.

It is not to be supposed that in their dealings with manufacturers, these wholesale-houses adopt a code of morals differing much from that which regulates their dealings with retailers. The facts prove it to be much the same. A buyer for instance (who exclusively conducts the purchases of a wholesale-house from manufacturers) will not unfrequently take from a first-class maker, a small supply of some new fabric, on the pattern of which much time and money have been spent; and this new-pattern fabric he will put into the hands of another maker, to have copied in large quantities. Some buyers, again, give their orders orally, that they may have the opportunity of afterwards repudiating them if they wish; and in a case narrated to us, where a manufacturer who had been thus deluded, wished on a subsequent occasion to guarantee himself by obtaining the buyer’s signature to his order, he was refused it. For other unjust acts of wholesale-houses, the heads of these establishments are, we presume, responsible. Small manufacturers working with insufficient capital, and in times of depression not having the wherewith to meet their engagements, are often obliged to become dependants on the wholesale-houses with which they deal; and are then cruelly taken advantage of. One who has thus committed himself, has either to sell his accumulated stock at a great sacrifice—thirty to forty per cent. below its value—or else to mortgage it; and when the wholesale-house becomes the mortgagee, the manufacturer has little chance of escape. He is obliged to work at the wholesale-dealer’s terms; and ruin almost certainly follows. This is especially the case in the silk-hosiery business. As was said to us by one of the larger silk-hosiers, who had watched the destruction of many of his smaller brethren—“They may be spared for a time as a cat spares a mouse; but they are sure to be eaten up in the end.” And we can the more readily credit this statement from having found that a like policy is pursued by some provincial curriers in their dealings with small shoe-makers; and also by hop-merchants and maltsters in their dealings with small publicans. We read that in Hindostan the ryots, when crops fall short, borrow from the Jews to buy seed; and once in their clutches are doomed. It seems that our commercial world can furnish parallels.

Of another class of wholesale-traders—those who supply grocers with foreign and colonial produce—we may say that though, in consequence of the nature of their business, their malpractices are less numerous and multiform, as well as less glaring, they bear the same stamp as the foregoing. Unless it is to be supposed that sugar and spices are moral antiseptics as well as physical ones, it must be expected that wholesale dealers in them will transgress much as other wholesale dealers do, in those directions where the facilities are greatest. And the truth is that, both in the qualities and quantities of the articles they sell, they take advantage of the retailers. The descriptions they give of their commodities are habitually misrepresentations. Samples sent round to their customers are characterized as first-rate when they are really second-rate. The travellers are expected to endorse these untrue statements; and unless the grocer has adequate keenness and extensive knowledge, he is more or less deceived. In some cases, indeed, no skill will save him. There are frauds that have grown up little by little into customs of the trade, which the retailer must submit to. In the purchase of sugar, for example, he is imposed on in respect alike of the goodness and the weight. The history of the dishonesty is this. Originally the tare allowed by the merchant on each hogshead, was 14 per cent. of the gross weight. The actual weight of the wood of which the hogshead was made, was at that time about 12 per cent. of the gross weight. And thus the trade-allowance left a profit of 2 per cent. to the buyer. Gradually, however, the hogshead has grown thicker and heavier; until now, instead of amounting to 12 per cent. of the gross weight, it amounts to 17 per cent. As the allowance of 14 per cent. still continues, the result is that the retail grocer loses 3 per cent.: to the extent of 3 per cent. he buys wood in place of sugar. In the quality of the sugar, he is deluded by the practice of giving him a sample from the best part of the hogshead. During its voyage from Jamaica or elsewhere, the contents of a hogshead undergo a slow drainage. The molasses, of which more or less is always present, filters from the uppermost part of the mass of sugar to the lowermost part; and this lowermost part, technically known as the “foots,” is of darker colour and smaller value. The quantity of it contained in a hogshead varies greatly; and the retailer, receiving a false sample, has to guess what the quantity of “foots” may be; and, to his cost, often under-estimates it. As will be seen from the following letter, copied from the Public Ledger for the 20th Oct., 1858, these grievances, more severe even than we have represented them, are now exciting an agitation.

“To the Retail Grocers of the United Kingdom.

“Gentlemen,—The time has arrived for the trade at once to make a move for the revision of tares on all raw sugars. Facts prove the evil of the present system to be greatly on the increase. We submit a case as under, and only one out of twenty. On the 30th August, 1858, we bought 3 hogsheads of Barbados, mark TGK

“We make a claim for £2. 1s. 3d.; we are told by the wholesale grocer there is no redress.

“There is another evil which the retail grocer has to contend with, that is, the mode of sampling raw sugars: the foots are excluded from the merchants’ samples. Facts will prove that in thousands of hogsheads of Barbados this season there is an average of 5 cwt. of foots in each; we have turned out some with 10 cwt., which are at least 5s. per cwt. less value than sample, and in these cases we are told again there is no redress.

“These two causes are bringing hundreds of hard-working men to ruin and will bring hundreds more unless the trade take it up, and we implore them to unite in obtaining so important a revision.

“We are, Gentlemen, your obedient servants,

“WALKER and STAINES. 6

6 The abuses described in this letter have now, we believe, been abolished.

A more subtle method of imposition remains to be added. It is the practice of sugar-refiners to put moist, crushed sugar into dried casks. During the time that elapses before one of these casks is opened by the retailer, the desiccated wood has taken up the excess of water from the sugar; which is thus brought again into good condition. When the retailer, finding that the cask weighs much more than was allowed as tare by the wholesale dealer, complains to him of this excess, the reply is—“Send it up to us, and we will dry it and weigh it, as is the custom of the trade.”

Without further detailing these malpractices, of which the above examples are perhaps the worst, we will advert only to one other point in the transactions of these large houses—the drawing-up of trade-circulars. It is the habit of many wholesale dealers to send round to their customers, periodic accounts of the past transactions, present condition, and prospects of the markets. Serving as checks on each other, as they do, these documents are prevented from swerving very widely from the truth. But it is scarcely to be expected that they should be quite honest. Those who issue them, being in most cases interested in the prices of the commodities referred to in their circulars, are swayed by their interests in the representations they make respecting the probabilities of the future. Far-seeing retailers are on their guard against this. A large provincial grocer, who thoroughly understands his business, said to us—“As a rule, I throw trade-circulars on the fire.” And that this estimate of their trustworthiness is not unwarranted, we gather from the expressions of those engaged in other businesses. From two leather-dealers, one in the country and one in London, we have heard the same complaint against the circulars published by houses in their trade, that they are misleading. Not that they state untruths; but that they produce false impressions by leaving out facts which they should have stated.

In illustrating the morality of manufacturers, we shall confine ourselves to one class—those who work in silk. And it will be the most convenient method of arranging facts, to follow the silk through its various stages; from its state when imported, to its state when ready for the wearer.

Bundles of raw silk from abroad—not uncommonly weighted with rubbish, stones, or rouleaux of Chinese copper coin, to the loss of the buyer—are disposed of by auction. Purchases are made on behalf of the silk-dealers by “sworn brokers;” and the regulation is, that these sworn brokers shall confine themselves to their functions as agents. From a silk-manufacturer, however, we learn that they are currently understood to be themselves speculators in silk, either directly or by proxy; and that as thus personally interested in prices, they become faulty as agents. We give this, however, simply as a prevailing opinion, for the truth of which we do not vouch.

The silk bought by the London dealer, he sends into the manufacturing districts to be “thrown;” that is, to be made into thread fit for weaving. In the established form of bargain between the silk-dealer and the silk-throwster, we have a strange instance of an organized and recognized deception; which has seemingly grown out of a check on a previous deception. The throwing of silk is necessarily accompanied by some waste, from broken ends, knots, and fibres too weak to wind. This waste varies in different kinds of silk from 3 per cent. to 20 per cent.: the average being about 5 per cent. The per-centage of waste being thus variable, it is obvious that in the absence of restraint, a dishonest silk-throwster might abstract a portion of the silk; and, on returning the rest to the dealer, might plead that the great diminution in weight had resulted from the large amount of loss in the process of throwing. Hence there has arisen a system, called “working on cost,” which requires the throwster to send back to the dealer the same weight of silk which he receives: the meaning of the phrase being, we presume, that whatever waste the throwster makes must be at his own cost. Now, as it is impossible to throw silk without some waste—at least 3 per cent., and ordinarily 5 per cent.—this arrangement necessitates a deception; if, indeed, that can be called a deception which is tacitly understood by all concerned. The silk has to be weighted. As much as is lost in throwing, has to be made up by some foreign substance introduced. Soap is largely used for this. In small quantity, soap is requisite to facilitate the running of the threads in the process of manufacture; and the quantity is readily increased. Sugar also is used. And by one means or other, the threads are made to absorb enough matter to produce the desired weight. To this system all silk-throwsters are obliged to succumb; and some of them carry it to a great extent, as a means of hiding either carelessness or something worse.

The next stage through which silk passes, is that of dyeing. Here, too, impositions have grown chronic and general. In times past, as we learn from a ribbon-manufacturer, the weighting by water was the chief dishonesty. Bundles returned from the dyer’s, if not manifestly damp, still, containing moisture enough to make up for a portion of the silk that had been kept back; and precautions had to be taken to escape losses thus entailed. Since then, however, there has arisen a method of deception which leaves this far behind—that of employing heavy dyes. The following details have been given us by a silk-throwster. It is now, he says, some five-and-thirty years since this method was commenced. Before that time silk lost a considerable part of its weight in the copper. The ultimate fibre of silk is coated, in issuing from the spinneret of the silk-worm, with a film of varnish which is soluble in boiling water. In dyeing, therefore, this film, amounting to 25 per cent. of the entire weight of the silk, is dissolved off; and the silk is rendered that much lighter. So that originally, for every sixteen ounces of silk sent to the dyer’s, only twelve ounces were returned. Gradually, however, by the use of heavy dyes, this result has been reversed. The silk now gains in weight; and sometimes to a scarcely credible extent. According to the requirement, silk is sent back from the dyer’s of any weight, from twelve ounces to the pound up to forty ounces to the pound. The original pound of silk, instead of losing four ounces, as it naturally would, is actually, when certain black dyes are used, made to gain as much as twenty-four ounces! Instead of 25 per cent. lighter, it is returned 150 per cent. heavier—is weighted with 175 per cent. of foreign matter! Now as, during this stage of its manufacture, the transactions in silk are carried on by weight, it is manifest that in the introduction and development of this system, we have a long history of frauds. At present all in the trade are aware of it, and on their guard against it. Like other modes of adulteration, in becoming established and universal, it has ceased to be profitable to any one. But it still serves to indicate the morals of those concerned.

The thrown and dyed silk passes into the hands of the weaver; and here again we come upon dishonesties. Manufacturers of figured silks sin against their fellows by stealing their patterns. The laws which have been found necessary to prevent this species of piracy, show that it has been carried to a great extent. Even now it is not prevented. One who has himself suffered from it, tells us that manufacturers still get one another’s designs by bribing the workmen. In their dealings with “buyers,” too, some manufacturers resort to deceptions: perhaps tempted to do so by the desire to compensate themselves for the heavy tax paid in treating, etc. Goods which have already been seen and declined by other buyers, are brought before a subsequent one with artfully-devised appearances of secrecy, accompanied by professions that these goods have been specially reserved for his inspection: a manœuvre by which an unwary man is sometimes betrayed. That the process of production has its delusions, scarcely needs saying. In the ribbon-trade, for example, there is a practice called “top-ending;” that is, making the first three yards good, and the rest (which is covered when rolled up) of bad or loose texture—80 “shutes” to the inch instead of 108. And then there comes the issuing of imitations made of inferior materials—textile adulterations as we may call them. This practice of debasement, not an occasional but an established one, is carried to a surprising extent, and with surprising rapidity. Some new fabric, first sold at 7s. 6d. per yard, is supplanted by successive counterfeits; until at the end of eighteen months a semblance of it is selling at 4s. 3d. per yard. Nay, still greater depreciations of quality and price take place—from 10s. down to 3s., and even 2s. per yard. Until at length the badness of these spurious fabrics becomes so conspicuous, that they are unsaleable; and there ensues a reaction, ending either in the reintroduction of the original fabric, or in the production of some novelty to supply its place.

Among our notes of malpractices in trade, retail, wholesale, and manufacturing, we have many others that must be passed over. We cannot here enlarge on the not uncommon trick of using false trade-marks; or of imitating another maker’s wrappers. We must be satisfied with simply referring to the doings of apparently-reputable houses, which purchase goods known to be dishonestly obtained. And we are obliged to refrain from particularizing certain established arrangements, existing under cover of the highest respectability, which seem intended to facilitate these nefarious transactions. The frauds we have detailed are but samples of a state of things which it would take a volume to describe in full.

The further instances of trading-immorality which it seems desirable here to give, are those which carry with them a certain excuse: showing as they do how insensibly, and almost irresistibly, men are thrust into vicious practices. Always, no doubt, some utterly unconscientious trader is the first to introduce a new form of fraud. He is by-and-by followed by others who wear their moral codes but loosely. The more upright traders are continually tempted to adopt this questionable device which those around them are adopting. The greater the number who yield, and the more familiar the device becomes, the more difficult is it for the remainder to stand out against it. The pressure of competition upon them becomes more and more severe. They have to fight an unequal battle: debarred as they are from one of the sources of profit which their antagonists possess. And they are finally almost compelled to follow the lead of the rest. Take for example what has happened in the candle-trade. As all know, the commoner kinds of candles are sold in bunches, supposed to weigh a pound each. Originally, the nominal weight corresponded with the real weight. But at present the weight is habitually short by an amount varying from half an ounce to two ounces—is sometimes depreciated 12 1⁄2 per cent. If, now, an honest chandler offers to supply a retailer at, say, six shillings for the dozen pounds, the answer he receives is—“Oh, we get them for five-and-eightpence.” “But mine,” replies the chandler, “are of full weight; while those you buy at five-and-eightpence are not.” “What does that matter to me?” the retailer rejoins—“a pound of candles is a pound of candles: my customers buy them in the bunch, and won’t know the difference between yours and another’s.” And the honest chandler, being everywhere met with this argument, finds that he must either make his bunches of short weight, or give up business. Take another case, which, like the last, we have direct from the mouth of one who has been obliged to succumb. It is that of a manufacturer of elastic webbing, now extensively used in making boots, etc. From a London house with which he dealt largely, this manufacturer recently received a sample of webbing produced by some one else, accompanied by the question, “Can you make us this at —— per yard?” (naming a price below that at which he had before supplied them); and hinting that if he could not do so they must go elsewhere. On pulling to pieces the sample (which he showed to us), this manufacturer found that sundry of the threads which should have been of silk were of cotton. Indicating this fact to those who sent him the sample, he replied that, if he made a like substitution, he could furnish the fabric at the price named; and the result was that he eventually did thus furnish it. He saw that if he did not do so, he must lose a considerable share of his trade. He saw further, that if he did not at once yield, he would have to yield in the end; for that other elastic-webbing-makers would one after another engage to produce this adulterated fabric at correspondingly diminished prices; and that when at length he stood alone in selling an apparently-similar article at a higher price, his business would leave him. This manufacturer we have the best reasons for knowing to be a man of fine moral nature, both generous and upright; and yet we here see him obliged, in a sense, to implicate himself in one of these processes of vitiation. It is a startling assertion, but it is none the less a true one, that those who resist these corruptions often do it at the risk of bankruptcy; sometimes the certainty of bankruptcy. We do not say this simply as a manifest inference from the conditions, as above described. We say it on the warrant of instances which have been given to us. From one brought up in his house, we have had the history of a draper who, carrying his conscience into his shop, refused to commit the current frauds of the trade. He would not represent his goods as of better quality than they really were; he would not say that patterns were just out, when they had been issued the previous season; he would not warrant to wash well, colours which he knew to be fugitive. Refraining from these and the like malpractices of his competitors; and, as a consequence, daily failing to sell various articles which his competitors would have sold by force of lying; his business was so unremunerative that he twice became bankrupt. And in the opinion of our informant, he inflicted more evil upon others by his bankruptcies, than he would have done by committing the usual trade-dishonesties. See, then, how complicated the question becomes; and how difficult to estimate the trader’s criminality. Often—generally indeed—he has to choose between two wrongs. He has tried to carry on his business with strict integrity. He has sold none but genuine articles, and has given full measure. Others in the same business adulterate or otherwise delude, and are so able to undersell him. His customers, not adequately appreciating the superiority in the quality or quantity of his goods, and attracted by the apparent cheapness at other shops, desert him. Inspection of his books proves the alarming fact that his diminishing returns will soon be insufficient to meet his engagements, and provide for his increasing family. What then must he do? Must he continue his present course; stop payment; inflict heavy losses on his creditors; and, with his wife and children, turn out into the streets? Or must he follow the example of his competitors; use their artifices; and give his customers the same apparent advantages? The last not only seems the least detrimental to himself, but also may be considered the least detrimental to others. Moreover, the like is done by men regarded as respectable. Why should he ruin himself and family in trying to be better than his neighbours? He will do as they do.

Such is the position of the trader; such is the reasoning by which he justifies himself; and it is hard to visit him with harsh condemnation. Of course this statement of the case is by no means universally true. There are businesses in which, competition being less active, the excuse for falling into corrupt practices does not hold; and here, indeed, we find corrupt practices much less prevalent. Many traders, too, have obtained connexions which secure to them adequate returns without descending to small rogueries; and they have no defence if they thus degrade themselves. Moreover, there are the men—commonly not prompted by necessity but by greed—who introduce these adulterations and petty frauds; and on these should descend unmitigated indignation: both as being themselves criminals without excuse, and as causing criminality in others. Leaving out, however, these comparatively small classes, most traders by whom the commoner businesses are carried on, must receive a much more qualified censure than they at first sight seem to deserve. On all sides we have met with the same conviction, that for those engaged in the ordinary trades there are but two courses—either to adopt the practices of their competitors, or to give up business. Men in different occupations and in different places—men naturally conscientious, who manifestly chafed under the degradations they submitted to, have one and all expressed to us the sad belief that it is impossible to carry on trade with strict rectitude. Their concurrent opinion, independently given by each, is that the scrupulously honest man must go to the wall.

But that it has been, during the past year, frequently treated by the daily press, we might here enter at some length on the topic of banking-delinquencies. As it is, we may presume all to be familiar with the facts, and shall limit ourselves to making a few comments.

In the opinion of one whose means of judging have been second to those of few, the directors of joint-stock-banks have rarely been guilty of direct dishonesty. Admitting notorious exceptions, the general fact appears to be that directors have had no immediate interests in furthering these speculations which have proved so ruinous to depositors and shareholders; but have usually been among the greatest sufferers. Their fault has rather been the less flagitious, though still grave fault, of indifference to their responsibilities. Often with very inadequate knowledge they have undertaken to trade with property belonging in great part to needy people. Instead of using as much care in the investment of this property as though it were their own, many of them have shown culpable recklessness: either themselves loaning the entrusted capital without adequate guarantee, or else passively allowing their colleagues to do this. Sundry excuses may doubtless be made for them. The well-known defects of a corporate conscience, caused by divided responsibility, must be remembered in mitigation. And it may also be pleaded for such delinquents that if shareholders, swayed by reverence for mere wealth and position, choose as directors, not the most intelligent, the most experienced, and those of longest-tried probity, but those of largest capital or highest rank, the blame must not be cast solely on the men so chosen, but must be shared by the men who choose them. Nay, further, it must fall on the public as well as on shareholders; seeing that this unwise selection of directors is in part determined by the known bias of depositors. But after all allowances have been made, it must be admitted that these bank-administrators who risk the property of their clients by lending it to speculators, are near akin in morality to the speculators themselves. As these speculators risk other men’s money in undertakings which they hope will be profitable; so do the directors who lend them the money. If these last plead that the money thus lent is lent with the belief that it will be repaid with good interest, the first may similarly plead that they expect their investment to return the borrowed capital along with a handsome profit. In each case the transaction is one of which the evil consequences, if they come, fall more largely on others than on the actors. And though it may be contended, on behalf of the director, that what he does is done chiefly for the benefit of his constituents, whereas the speculator has in view only his own benefit; it may be replied that the director’s blameworthiness is not the less because he took a rash step with a comparatively weak motive. The truth is that when a bank-director lends the capital of shareholders to those to whom he would not lend his own capital, he is guilty of a breach of trust. In tracing the gradations of crime, we pass from direct robbery to robbery one, two, three, or more degrees removed. Though a man who speculates with other people’s money is not chargeable with direct robbery, he is chargeable with robbery one degree removed: he deliberately stakes his neighbour’s property, intending to appropriate the gain, if any, and to let his neighbour suffer the loss, if any: his crime is that of contingent robbery. And hence any one who, standing like a bank-director in the position of trustee, puts the money with which he is entrusted into a speculator’s hands, must be called an accessory to contingent robbery.

If so grave a condemnation is to be passed on those who lend trust-money to speculators, as well as on the speculators who borrow it, what shall we say of the still more delinquent class who obtain loans by fraud—who not only pawn other men’s property when obtained, but obtain it under false pretences? For how else than thus must we describe the doings of those who raise money by accommodation-bills? When A and B agree, the one to draw and the other to accept a bill of £1000 for “value received;” while in truth there has been no sale of goods between them, or no value received; the transaction is not simply an embodied lie, but it becomes thereafter a living and active lie. Whoever discounts the bill, does so in the belief that B, having become possessed of £1000 worth of goods, will, when the bill falls due, have either the £1000 worth of goods or some equivalent, with which to meet it. Did he know that there were no such goods in the hands of either A or B, and no other property available for liquidating the bill, he would not discount it—he would not lend money to a man of straw without security. Had A taken to the bank a forged mortgage-deed, and obtained a loan upon it, he would not have committed a greater wrong. Practically, an accommodation-bill is a forgery. It is an error to suppose that forgery is limited to the production of documents that are physically false—that contain signatures or other symbols which are not what they appear to be: forgery, properly understood, equally includes the production of documents that are morally false. What constitutes the crime committed in forging a bank-note? Not the mere mechanical imitation. This is but a means to the end; and, taken alone, is no crime at all. The crime consists in deluding others into the acceptance of what seems to be a representative of so much money, but which actually represents nothing. It matters not whether the delusion is effected by copying the forms of the letters and figures, as in a forged bank-note, or by copying the form of expression, as in an accommodation-bill. In either case a semblance of value is given to that which has no value; and it is in giving this false appearance of value that the crime consists. It is true that generally, the acceptor of an accommodation-bill hopes to be able to meet it when due. But if those who think this exonerates him, will remember the many cases in which, by the use of forged documents, men have obtained possession of moneys which they hoped presently to replace, and were nevertheless judged guilty of forgery, they will see that the plea is insufficient. We contend, then, that the manufacturers of accommodation-bills should be classed as forgers. That if the law so classed them, much good would result, we are not prepared to say. Several questions present themselves:—Whether such a change would cause inconvenience, by negativing the many harmless transactions carried on under this fictitious form by solvent men? Whether making it penal to use the words “value received,” unless there had been value received, would not simply originate an additional class of bills in which these words were omitted? Whether it would be an advantage if bills bore on their faces proofs that they did or did not represent actual sales? Whether a restraint on undue credit would result, when bankers and discounters saw that certain bills coming to them in the names of speculative or unsubstantial traders, were avowed accommodation-bills? But these are questions we need not go out of our way to discuss. We are here concerned only with the morality of the question.

Duly to estimate the greatness of the evils indicated, however, we must bear in mind both that the fraudulent transactions thus entered into are numerous, and that each generally becomes the cause of others. The original lie is commonly the parent of further lies, which again give rise to an increasing progeny; and so on for successive generations, multiplying as they descend. When A and B find their £1000 bill about to fall due, and the expected proceeds of their speculation not forthcoming—when they find, as they often do, either that the investment has resulted in a loss instead of a gain; or that the time for realizing their hoped-for profits, has not yet come; or that the profits, if there are any, do not cover the extravagances of living which, in the meantime, they have sanguinely indulged in—when, in short, they find that the bill cannot be taken up; they resort to the expedient of manufacturing other bills with which to liquidate the first. And while they are about it, they usually think it will be as well to raise a somewhat larger sum than is required to meet their outstanding engagements. Unless it happens that great success enables them to redeem themselves, this proceeding is repeated, and again repeated. So long as there is no monetary crisis, it continues easy thus to keep afloat; and, indeed, the appearance of prosperity which is given by an extended circulation of bills in their names, bearing respectable indorsements, creates a confidence in them which renders the obtainment of credit easier than at first. And where, as in some cases, this process is carried to the extent of employing men in different towns throughout the kingdom, and even in distant parts of the world, to accept bills, the appearances are still better kept up, and the bubble reaches a still greater development. As, however, all these transactions are carried on with borrowed capital, on which interest has to be paid; as, further, the maintenance of this organized fraud entails constant expenses, as well as occasional sacrifices; and as it is in the very nature of the system to generate reckless speculation; the fabric of lies is almost certain ultimately to fall; and, in falling, to ruin or embarrass others besides those who had given credit.

Nor does the evil end with the direct penalties from time to time inflicted on honest traders. There is also a grave indirect penalty which they suffer from the system. These forgers of credit are habitually instrumental in lowering prices below their natural level. To meet emergencies, they are obliged every now and then to sell goods at a loss: the alternative being immediate stoppage. Though with each such concern, this is but an occasional incident, yet, taking the whole number of them connected with any one business, it results that there are generally some who are making sacrifices—generally some who are unnaturally depressing the market. In short, the capital fraudulently obtained from some traders is, in part, dissipated in rendering the business of other traders deficiently remunerative: often to their serious embarrassment.

If, however, the whole truth must be said, the condemnation visited on these commercial vampires is not to be confined to them; but is in some degree deserved by a much more numerous class. Between the penniless schemer who obtains the use of capital by false pretences, and the upright trader who never contracts greater liabilities than his estate will liquidate, there lie all gradations. From businesses carried on entirely with other people’s capital, obtained by forgery, we pass to businesses in which there is a real capital of one-tenth and a credit-capital of nine-tenths; to other businesses in which the ratio of real to fictitious capital is somewhat greater; and so on until we reach the very extensive class of men who trade but a little beyond their means. To get more credit than would be given were the state of the business known, is in all cases the aim; and the cases in which this credit is partially unwarranted, differ only in degree from those in which it is wholly unwarranted. As most are beginning to see, the prevalence of this indirect dishonesty has not a little to do with our commercial disasters. Speaking broadly, the tendency is for every trader to hypothecate the capital of other traders, as well as his own. And when A has borrowed on the strength of B’s credit; B on the strength of C’s; and C on the strength of A’s—when, throughout the trading world, each has made engagements which he can meet only by direct or indirect aid—when everybody is wanting help from some one else to save him from falling; a crash is certain. The punishment of a general unconscientiousness may be postponed, but it is sure to come eventually.

The average commercial morality cannot, of course, be accurately depicted in so brief a space. On the one hand, we have been able to give but a few typical instances of the malpractices by which trade is disgraced. On the other hand, we have been obliged to present these alone; unqualified by the large amount of honest dealing throughout which they are dispersed. While, by accumulating such evidences, the indictment may be made heavier; by diluting them with the immense mass of equitable transactions daily carried on, the verdict would be mitigated. After making every allowance, however, we fear that the state of things is very bad. Our impression on this point is due less to the particular facts above given, than to the general opinion expressed by our informants. On all sides we have found the result of long personal experience, to be the conviction that trade is essentially corrupt. In tones of disgust or discouragement, reprehension or derision, according to their several natures, men in business have one after another expressed or implied this belief. Omitting the highest mercantile classes, a few of the less common trades, and those exceptional cases where an entire command of the market has been obtained, the uniform testimony of competent judges is, that success is incompatible with strict integrity. To live in the commercial world it appears necessary to adopt its ethical code: neither exceeding nor falling short of it—neither being less honest nor more honest. Those who sink below its standard are expelled; while those who rise above it are either pulled down to it or ruined. As, in self-defence, the civilized man becomes savage among savages; so, it seems that in self-defence, the scrupulous trader is obliged to become as little scrupulous as his competitors. It has been said that the law of the animal creation is—“Eat and be eaten;” and of our trading community it may similarly be said that its law is—Cheat and be cheated. A system of keen competition, carried on, as it is, without adequate moral restraint, is very much a system of commercial cannibalism. Its alternatives are—Use the same weapons as your antagonists or be conquered and devoured.

Of questions suggested by these facts, one of the most obvious is—Are not the prejudices which have ever been entertained against trade and traders, thus fully justified? do not these meannesses and dishonesties, and the moral degradation they imply, warrant the disrespect shown to men in business? A prompt affirmative answer will probably be looked for; but we very much doubt whether it should be given. We are rather of opinion that these delinquencies are products of the average character placed under special conditions. There is no reason for assuming that the trading classes are intrinsically worse than other classes. Men taken at random from higher and lower ranks, would, most likely, if similarly circumstanced, do much the same. Indeed the mercantile world might readily recriminate. Is it a solicitor who comments on their misdoings? They may quickly silence him by referring to the countless dark stains on the reputation of his fraternity. Is it a barrister? His frequent practice of putting in pleas which he knows are not valid, and his established habit of taking fees for work he does not perform, make his criticism somewhat suicidal. Does the condemnation come through the press? The condemned may remind those who write, of the fact that it is not quite honest to utter a positive verdict on a book merely glanced through, or to pen glowing eulogies on the mediocre work of a friend while slighting the good one of an enemy; and they may further ask whether those who, at the dictation of an employer, write what they disbelieve, are not guilty of the serious offence of adulterating public opinion. Moreover, traders might contend that many of their delinquencies are thrust on them by the injustice of their customers. They, and especially drapers, might point to the fact that the habitual demand for an abatement of price, is made in utter disregard of their reasonable profits; and that, to protect themselves against attempts to gain by their loss, they are obliged to name prices greater than those they intend to take. They might also urge that the straits to which they are often brought by non-payment of large sums due from their wealthier customers, is itself a cause of their malpractices: obliging them, as it does, to use all means, illegitimate as well as legitimate, for getting the wherewith to meet their engagements. And then, after proving that those without excuse show this disregard of other men’s claims, traders might ask whether they, who have the excuse of having to contend with a merciless competition, are alone to be blamed if they display a like disregard in other forms. Nay, even to the guardians of social rectitude—members of the legislature—they might use the tu quoque argument: asking whether bribery of a customer’s servant, is any worse than bribery of an elector? or whether the gaining of suffrages by clap-trap hustings-speeches, containing insincere professions adapted to the taste of the constituency, is not as bad as getting an order for goods by delusive representations respecting their quality? No; few if any classes are free from immoralities which are as great, relatively to the temptations, as these we have been exposing. Of course they will not be so petty or so gross where the circumstances do not prompt pettiness or grossness; nor so constant and organized where the class-conditions have not tended to make them habitual. But, taken with these qualifications, we think that much might be said for the proposition that the trading classes, neither better nor worse intrinsically than other classes, are betrayed into their flagitious habits by external causes.

Another question, here naturally arising, is—Are not these evils growing worse? Many of the facts we have cited seem to imply that they are. Yet there are many other facts which point as distinctly the other way. In weighing the evidence, we must bear in mind that the greater public attention at present paid to such matters, is itself a source of error—is apt to generate the belief that evils now becoming recognized are evils that have recently arisen; when in truth they have merely been hitherto disregarded, or less regarded. It has been clearly thus with crime, with distress, with popular ignorance; and it is very probably thus with trading-dishonesties. As it is true of individual beings, that their height in the scale of creation may be measured by the degree of their self-consciousness; so, in a sense, it is true of societies. Advanced and highly-organized societies are distinguished from lower ones by the evolution of something that stands for a social self-consciousness. Among ourselves there has, happily, been of late years a remarkable growth of this social self-consciousness; and we believe that to this is chiefly ascribable the impression that commercial malpractices are increasing. Such facts as have come down to us respecting the trade of past times, confirm this view. In his Complete English Tradesman, Defoe mentions, among other manœuvres of retailers, the false lights which they introduced into their shops, for the purpose of giving delusive appearances to their goods. He comments on the “shop rhetorick,” the “flux of falsehoods,” which tradesmen habitually uttered to their customers; and quotes their defence as being that they could not live without lying. He says, too, that there was scarce a shopkeeper who had not a bag of spurious or debased coin, from which he gave change whenever he could; and that men, even the most honest, triumphed in their skill in getting rid of bad money. These facts show that the mercantile morals of that day were, at any rate, not better than ours; and if we call to mind the numerous Acts of Parliament passed in old times to prevent frauds of all kinds, we perceive the like implication. As much may, indeed, be safely inferred from the general state of society. When, reign after reign, governments debased the coinage, the moral tone of the middle classes could scarcely have been higher than now. Among generations whose sympathy with the claims of fellow-creatures was so weak, that the slave-trade was not only thought justifiable, but the initiator of it was rewarded by permission to record the feat in his coat of arms, it is hardly possible that men respected the claims of their fellow-citizens more than at present. Times characterized by an administration of justice so inefficient, that there were in London nests of criminals who defied the law, and on all high roads robbers who eluded it, cannot have been distinguished by just mercantile dealings. While, conversely, an age which, like ours, has seen so many equitable social changes thrust on the legislature by public opinion, is very unlikely to be an age in which the transactions between individuals have been growing more inequitable. Yet, on the other hand, it is undeniable that many of the dishonesties we have described are of modern origin. Not a few of them have become established during the last thirty years; and others are even now arising. How are these seeming contradictions to be reconciled?

The reconciliation is not difficult. It lies in the fact that while the direct frauds have been diminishing, the indirect frauds have been increasing: alike in variety and in number. And this admission we take to be consistent with the opinion that the standard of commercial morals is higher than it was. For if we omit, as excluded from the question, the penal restraints—religious and legal—and ask what is the ultimate moral restraint to the aggression of man on man, we find it to be—sympathy with the pain inflicted. Now the keenness of the sympathy, depending on the vividness with which this pain is realized, varies with the conditions of the case. It may be active enough to check misdeeds which will manifestly cause great suffering, and yet not be active enough to check misdeeds which will cause but slight annoyance. While sufficiently acute to prevent a man from doing that which will entail immediate injury on a known person, it may not be sufficiently acute to prevent him from doing that which will entail remote injuries on unknown persons. And we find the facts to agree with this deduction, that the moral restraint varies according to the clearness with which the evil consequences are conceived. Many a one who would shrink from picking a pocket does not scruple to adulterate his goods; and he who never dreams of passing base coin will yet be a party to joint-stock-bank deceptions. Hence, as we say, the multiplication of the more subtle and complex forms of fraud, is consistent with a general progress in morality; provided it is accompanied with a decrease in the grosser forms of fraud.

But the question which most concerns us is, not whether the morals of trade are better or worse than they have been? but rather—why are they so bad? Why in this civilized state of ours, is there so much that betrays the cunning selfishness of the savage? Why, after the careful inculcations of rectitude during education, comes there in after-life all this knavery? Why, in spite of all the exhortations to which the commercial classes listen every Sunday, do they next morning recommence their evil deeds? What is this so potent agency which almost neutralizes the discipline of education, of law, of religion?

Various subsidiary causes that might be assigned, must be passed over, that we may have space to deal with the chief cause. In an exhaustive statement, something would have to be said on the credulity of consumers, which leads them to believe in representations of impossible advantages; and something, too, on their greediness, which, ever prompting them to look for more than they ought to get, encourages sellers to offer delusive bargains. The increased difficulty of living consequent on growing pressure of population, might perhaps come in as a part cause; and that greater cost of bringing up a family, which results from the higher standard of education, might be added. But the chief inciter of these trading malpractices is intense desire for wealth. And if we ask—Why this intense desire? the reply is—It results from the indiscriminate respect paid to wealth.

To be distinguished from the common herd—to be somebody—to make a name, a position—this is the universal ambition; and to accumulate riches is alike the surest and the easiest way of fulfilling this ambition. Very early in life all learn this. At school, the court paid to one whose parents have called in their carriage to see him, is conspicuous; while the poor boy whose insufficient stock of clothes implies the small means of his family, soon has burnt into his memory the fact that poverty is contemptible. On entering the world, the lessons which may have been taught about the nobility of self-sacrifice, the reverence due to genius, the admirableness of high integrity, are quickly neutralized by experience: men’s actions proving that these are not their standards of respect. It is soon perceived that while abundant outward marks of deference from fellow-citizens may almost certainly be gained by directing every energy to the accumulation of property, they are but rarely to be gained in any other way; and that even in the few cases in which they are otherwise gained, they are not given with entire unreserve, but are commonly joined with a more or less manifest display of patronage. When, seeing this, the young man further sees that while the acquisition of property is possible with his mediocre endowments, the acquirement of distinction by brilliant discoveries, or heroic acts, or high achievements in art, implies faculties and feelings which he does not possess; it is not difficult to understand why he devotes himself heart and soul to business.

We do not mean to say that men act on the consciously reasoned-out conclusions thus indicated; but we mean that these conclusions are the unconsciously-formed products of their daily experiences. From early childhood the sayings and doings of all around them have generated the idea that wealth and respectability are two sides of the same thing. This idea, growing with their growth, and strengthening with their strength, becomes at last almost what we may call an organic conviction. And this organic conviction it is which prompts the expenditure of all their energies in money-making. We contend that the chief stimulus is not the desire for the wealth itself, but for the applause and position which the wealth brings. And in this belief, we find ourselves at one with various intelligent traders with whom we have talked on the matter. It is incredible that men should make the sacrifices, mental and bodily, which they do, merely to get the material benefits which money purchases. Who would undertake an extra burden of business for the purpose of getting a cellar of choice wines for his own drinking? He who does it, does it that he may have choice wines to give his guests and gain their praises. What merchant would spend an additional hour at his office daily, merely that he might move into a house in a more fashionable quarter? He submits to the tax not to gain health and comfort but for the sake of the increased social consideration which the new house will bring him. Where is the man who would lie awake at nights devising means of increasing his income, in the hope of being able to provide his wife with a carriage, were the use of the carriage the sole consideration? It is because of the éclat which the carriage will give, that he enters on these additional anxieties. So manifest, so trite, indeed, are these truths, that we should be ashamed of insisting on them, did not our argument require it.

For if the desire for that homage which wealth brings, is the chief stimulus to these strivings after wealth, then the giving of this homage (when given, as it is, with but little discrimination) is the chief cause of the dishonesties into which these strivings betray mercantile men. When the shopkeeper, on the strength of a prosperous year and favourable prospects, has yielded to his wife’s persuasions, and replaced the old furniture with new, at an outlay greater than his income covers—when, instead of the hoped-for increase, the next year brings a decrease in his returns—when he finds that his expenses are out-running his revenue; then does he fall under the strongest temptation to adopt some newly-introduced adulteration or other malpractice. When, having by display gained a certain recognition, the wholesale trader begins to give dinners appropriate only to those of ten times his income, with other expensive entertainments to match—when, having for a time carried on this style at a cost greater than he can afford, he finds that he cannot discontinue it without giving up his position; then is he most strongly prompted to enter into larger transactions, to trade beyond his means, to seek undue credit, to get into that ever-complicating series of misdeeds which ends in disgraceful bankruptcy. And if these are the facts then is it an unavoidable conclusion that the blind admiration which society gives to mere wealth, and the display of wealth, is the chief source of these multitudinous immoralities.

Yes, the evil is deeper than appears—draws its nutriment from far below the surface. This gigantic system of dishonesty, branching out into every conceivable form of fraud, has roots which run underneath our whole social fabric, and, sending fibres into every house, suck up strength from our daily sayings and doings. In every dining-room a rootlet finds food, when the conversation turns on So-and-so’s successful speculations, his purchase of an estate, his probable worth—on this man’s recent large legacy, and the other’s advantageous match; for being thus talked about is one form of that tacit respect which men struggle for. Every drawing-room furnishes nourishment in the admiration awarded to costliness—to silks that are “rich,” that is, expensive; to dresses that contain an enormous quantity of material, that is, are expensive; to laces that are hand-made, that is, expensive; to diamonds that are rare, that is, expensive; to china that is old, that is, expensive. And from scores of small remarks and minutiæ of behaviour which, in all circles, hourly imply how completely the idea of respectability involves that of costly externals, there is drawn fresh pabulum.

We are all implicated. We all, whether with self-approbation or not, give expression to the established feeling. Even he who disapproves this feeling finds himself unable to treat virtue in threadbare apparel with a cordiality as great as that which he would show to the same virtue endowed with prosperity. Scarcely a man is to be found who would not behave with more civility to a knave in broadcloth than to a knave in fustian. Though for the deference which they have shown to the vulgar rich, or the dishonestly successful, men afterwards compound with their consciences by privately venting their contempt; yet when they again come face to face with these imposing externals covering worthlessness, they do as before. And so long as imposing worthlessness gets the visible marks of respect, while the disrespect felt for it is hidden, it naturally flourishes.

Hence, then, is it that men persevere in these evil practices which all condemn. They can so purchase a homage which, if not genuine, is yet, so far as appearances go, as good as the best. To one whose wealth has been gained by a life of frauds, what matters it that his name is in all circles a synonym of roguery? Has he not been conspicuously honoured by being twice elected mayor of his town? (we state a fact) and does not this, joined to the personal consideration shown him, outweigh in his estimation all that is said against him; of which he hears scarcely anything? When, not many years after the exposure of his inequitable dealing, a trader attains to the highest civic distinction which the kingdom has to offer, and that, too, through the instrumentality of those who best know his delinquency, is not the fact an encouragement to him, and to all others, to sacrifice rectitude to aggrandizement? If, after listening to a sermon that has by implication denounced the dishonesties he has been guilty of, the rich ill-doer finds, on leaving church, that his neighbours cap to him, does not this tacit approval go far to neutralize the effect of all he has heard? The truth is that with the great majority of men, the visible expression of social opinion is far the most efficient of incentives and restraints. Let any one who wishes to estimate the strength of this control, propose to himself to walk through the streets in the dress of a dustman, or hawk vegetables from door to door. Let him feel, as he probably will, that he had rather do something morally wrong than commit such a breach of usage and suffer the resulting derision. He will then better estimate how powerful a curb to men is the open disapproval of their fellows, and how, conversely, the outward applause of their fellows is a stimulus surpassing all others in intensity. Fully realizing which facts, he will see that the immoralities of trade are in great part traceable to an immoral public opinion.

Let none infer, from what has been said, that the payment of respect to wealth rightly acquired and rightly used, is deprecated. In its original meaning, and in due degree, the feeling which prompts such respect is good. Primarily, wealth is the sign of mental power; and this is always respectable. To have honestly-acquired property, implies intelligence, energy, self-control; and these are worthy of the homage that is indirectly paid to them by admiring their results. Moreover, the good administration and increase of inherited property, also requires its virtues; and therefore demands its share of approbation. And besides being applauded for their display of faculty, men who gain and increase wealth are to be applauded as public benefactors. For he who, as manufacturer or merchant, has, without injustice to others, realized a fortune, is thereby proved to have discharged his functions better than those who have been less successful. By greater skill, better judgment, or more economy than his competitors, he has afforded the public greater advantages. His extra profits are but a share of the extra produce obtained by the same outlay: the other share going to the consumers. And similarly, the landowner who, by judicious investment of money, has increased the value (that is, the productiveness) of his estate, has thereby added to the stock of national capital. By all means, then, let the right acquisition and proper use of wealth have their due share of admiration.

But that which we condemn as the chief cause of commercial dishonesty, is the indiscriminate admiration of wealth—an admiration that has little or no reference to the character of the possessor. When, as generally happens, the external signs are reverenced where they signify no internal worthiness—nay, even where they cover internal unworthiness; then does the feeling become vicious. It is this idolatry which worships the symbol apart from the thing symbolized, that is the root of all these evils we have been exposing. So long as men pay homage to those social benefactors who have grown rich honestly, they give a wholesome stimulus to industry; but when they accord a share of their homage to those social malefactors who have grown rich dishonestly, then do they foster corruption—then do they become accomplices in all these frauds of commerce.

As for remedy, it manifestly follows that there is none save a purified public opinion. When that abhorrence which society now shows to direct theft, is shown to theft of all degrees of indirectness; then will these mercantile vices disappear. When not only the trader who adulterates or gives short measure, but also the merchant who over-trades, the bank-director who countenances an exaggerated report, and the railway-director who repudiates his guarantee, come to be regarded as of the same genus as the pickpocket, and are treated with like disdain; then will the morals of trade become what they should be.

We have little hope, however, that any such higher tone of public opinion will shortly be reached. The present condition of things appears to be, in great measure, a necessary accompaniment of our present phase of progress. Throughout the civilized world, especially in England, and above all in America, social activity is almost wholly expended in material development. To subjugate Nature and bring the powers of production and distribution to their highest perfection, is the task of our age, and probably will be the task of many future ages. And as in times when national defence and conquest were the chief desiderata, military achievement was honoured above all other things; so now, when the chief desideratum is industrial growth, honour is most conspicuously given to that which generally indicates the aiding of industrial growth. The English nation at present displays what we may call the commercial diathesis; and the undue admiration for wealth appears to be its concomitant—a relation still more conspicuous in the worship of “the almighty dollar” by the Americans. And while the commercial diathesis, with its accompanying standard of distinction, continues, we fear the evils we have been delineating can be but partially cured. It seems hopeless to expect that men will distinguish between that wealth which represents personal superiority and benefits done to society, from that which does not. The symbols, the externals, have all the world through swayed the masses, and must long continue to do so. Even the cultivated, who are on their guard against the bias of associated ideas, and try to separate the real from the seeming, cannot escape the influence of current opinion. We must therefore content ourselves with looking for a slow amelioration.

Something, however, may even now be done by vigorous protest against adoration of mere success. And it is important that it should be done, considering how this vicious sentiment is being fostered. When we have one of our leading moralists preaching, with increasing vehemence, the doctrine of sanctification by force—when we are told that while a selfishness troubled with qualms of conscience is contemptible, a selfishness intense enough to trample down everything in the unscrupulous pursuit of its ends is worthy of admiration—when we find that if it be sufficiently great, power, no matter of what kind or how directed, is held up for our reverence; we may fear lest the prevalent applause of mere success, together with the commercial vices which it stimulates, should be increased rather than diminished. Not at all by this hero-worship grown into brute-worship is society to be made better, but by exactly the opposite—by a stern criticism of the means through which success has been achieved, and by according honour to the higher and less selfish modes of activity.

And happily the signs of this more moral public opinion are showing themselves. It is becoming a tacitly-received doctrine that the rich should not, as in bygone times, spend their lives in personal gratification; but should devote them to the general welfare. Year by year is the improvement of the people occupying a larger share of the attention of the upper classes. Year by year are they voluntarily devoting more energy to furthering the material and mental progress of the masses. And those among them who do not join in the discharge of these high functions, are beginning to be looked upon with more or less contempt by their own order. This latest and most hopeful fact in human history—this new and better chivalry—promises to evolve a higher standard of honour, and so to ameliorate many evils: among others those which we have detailed. When wealth obtained by illegitimate means inevitably brings nothing but disgrace—when to wealth rightly acquired is accorded only its due share of homage, while the greatest homage is given to those who consecrate their energies and their means to the noblest ends; then may we be sure that, along with other accompanying benefits, the morals of trade will be greatly purified.